Chancellor Rishi Sunak has said today that homeowners will pay 0% VAT on energy saving materials, such as solar panels or heat pumps, for the next five years.

The news comes as part of the Spring Statement, and applies to the installation of the following energy saving materials:

- Solar panels

- Ground source heat pumps

- Air source heat pumps

- Insulation

- Controls for central heating and hot water systems

- Draught stripping

- Micro combined heat and power units

- Wood-fuelled boilers

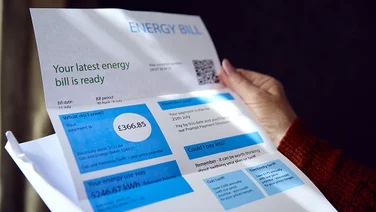

Energy saving materials are currently subject to a VAT rate of 20%. However, installations are subject to a reduced 5% VAT rate for people on certain benefits, or if the cost of the products/materials is not over 60% of the cost of installation.

By removing the VAT, the government could help incentivise Brits to buy low-carbon tech, which will not only reduce energy bills, but also shrink household carbon emissions.

You can find out more information about VAT rates for solar panels on our page.

Why is the government scrapping VAT on energy saving materials?

This is part of a wider mission to help households during the energy crisis. By investing in solar panels or heat pumps, Brits could cut back on gas and electricity bills.

Solar panel costs have dropped by a whopping 50% since 2011, and could save homeowners £608 a year on energy bills – or £7,349 over 25 years.

Although this new legislation will be useful for people who have a few thousand pounds to spare, it’s not likely to help those who are really struggling during the energy crisis.

It’s been estimated that 6.32 million households could be pushed into fuel poverty as a result of the latest price cap rise from 1 April 2022.

These millions of people who are struggling to power their homes won’t be able to fork out a few thousand pounds to buy solar panels or heat pumps – even with VAT knocked off.