✔ The wholesale price of gas is lower than it’s been for 19 months

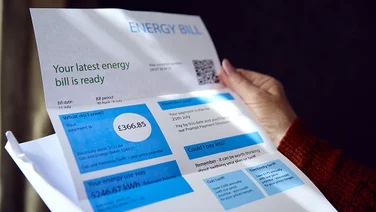

✔ The energy price cap is currently £2,074

✔ This is a fall of 17% compared to the previous cap

Gas prices have been mind-bogglingly high for a while, thanks to a perfect storm of cascading problems.

At its worst point, the wholesale price of gas increased by 404% over 12 months.

With 85% of UK households heated by gas boilers, this produced a massive ripple effect which has led to spiralling costs and reduces in supply.

Companies have shut down, energy bills have skyrocketed, and we’re in a full-blown energy and cost of living crisis – and though the wholesale cost of gas has rapidly fallen during 2023, this drop isn’t yet reflected in your energy bills.

Here’s how we reached this disastrous reality, and how it will affect you.

The 6 key reasons

1. We don’t have enough gas

2. Russia’s invasion of Ukraine

3. We had a long winter

4. Most energy sources have struggled

5. Other nations are buying more gas

6. Our European suppliers are suffering

1. We don’t have enough gas

The UK’s gas storage levels are “historically low,” according to Ofgem chief executive Jonathan Brearley.

We have just 10 terawatt hours (TWh) of gas, according to Gas Infrastructure Europe. Compare that to Italy’s 166, Germany’s 216, France’s 125 TWh, and the Netherlands’ 116 TWh.

Many of these countries have been able to quickly gather more gas stocks over the past few months. France, for instance, has increased its gas storage levels by 380%.

The UK has also increased its reserves – but by a relatively paltry 22%.

But wait, maybe we don’t need as much gas as countries like the Netherlands?

Nope. We consume 512 TWh of gas per year, according to the government – 25% more than the Netherlands’ 408.67 TWh total, according to Dutch government data.

And when supply is low and demand stays the same, prices rise.

This is also true compared to other European countries, which are also suffering from a smaller than usual gas supply – but to nowhere near the extent of the UK.

And yet, the governments of France, Greece, Italy, and Spain have already intervened to reduce the cost of energy bills and slow the growing crisis.

This is driving more UK households to swap their old gas boilers for low-carbon alternatives, such as heat pumps or infrared heating panels.

2. Russia’s invasion of Ukraine

In February, Russia invaded Ukraine in a horrific escalation of a war that started in 2014.

Countless countries and companies have condemned Russia’s actions, created sanctions, and made plans to reduce their reliance on Russian gas.

Unfortunately, these moves have raised gas prices even further.

Avoiding Russian gas reduces global supply levels while demand stays high, and sanctions have raised the cost of Russian gas production.

The fear of further sanctions has also prompted panic buying, which will worsen every time Putin’s regime threatens to cut off its gas supply to Europe.

The price of gas also rises every time Russia follows through with this threat, as it did in September 2022 when it closed the Nord Stream 1 pipeline, blaming international sanctions for the closure.

Russia supplies less than 5% of the UK’s gas – but it supplies 40% of the EU’s gas, more than any other nation.

The EU is looking into ways to become independent from Russian gas, but this is likely to be a messy, lengthy divorce.

In the short term, if European nations stop buying Russian gas, they’ll need to dramatically reduce their own exports, which the UK relies on.

Want to learn more? Check out How And When Will The UK Stop Using Gas?

3. We had a long winter

One reason why we have less gas than normal is that we used a lot of it over the winter of 2020/21, which lasted far longer than usual.

This wasn’t just true of the UK, either. Across Europe and Asia, people endured a lengthy winter caused by climate change.

It was the coldest April in the UK since 1922, and the coldest in Europe since 2003, according to the European Union’s Copernicus programme.

Colder temperatures produced an increase in demand for gas, which created an unusually large reduction in our supplies.

4. Most energy sources have struggled

We’ve had a tough couple of years for most of the UK’s sources of power.

Nuclear reactors have suffered repeated outages. At the time of writing, four of EDF Energy’s 14 reactors were offline for “non-planned” reasons.

A major fire at the Kent site of the 2,000 megawatt IFA power cable – which brings electricity from France to the UK – halted the supply for months.

Some coal power plants, which were due to all be shut down by October 2024, have been brought back online to help with the shortfall in supply – but it’s not enough.

And unfortunately, the UK has often produced less wind and solar power than expected.

Some months have seen wind farms operating at just 11% of their capacity (at worst), and summers are getting less windy.

Don’t use this crisis to denigrate renewable sources, though.

Energy Secretary Kwasi Kwarteng said as much when he tweeted that “our exposure to volatile global gas prices underscores the importance of our plan to build a strong, home-grown renewable energy sector to further reduce our reliance on fossil fuels.”

The bottom line is that the UK is facing this crisis because it relies so heavily on gas. 85% of households use gas boilers for heating. That’s too much.

62% of UK residents want the government to replace gas with green power, and we must head in that direction, for all our sakes.

5. Asian and South American nations are buying more gas

The UK would normally have purchased more liquefied natural gas (LNG) than usual to make up for shortfalls in most other energy sources, but soaring global demand has made this option impossible.

Over the past year or so, Asian nations including China, Japan, and South Korea have bought up huge quantities of LNG in an effort to transition their energy supply from coal to gas.

China imported 27% more LNG in the first half of 2021 than it did in the same period of 2020, according to McKinsey & Company.

South American countries have also significantly increased their LNG import levels, reaching record levels in 2021 as Brazil and Argentina in particular ratcheted up their orders.

The increased demand in these countries saw European LNG imports fall by 19% during the first six months of 2021.

This is an energy source that made up 22% of the UK’s energy supply in 2020, so the sudden lack of access had a big impact.

The UK imported around 100 TWh of LNG from Qatar, and 34 TWh and 33 TWh from Russia and the US, respectively, in 2020 – about 33% of our total gas consumption, all together.

Those supplies dried up in 2021, with Ofgem explaining that “LNG deliveries have been significantly diverted this year to Asia and South America due to increased demand and prices in those regions.”

6. Our usual European suppliers are suffering

When one source isn’t giving you the power you need, go to another – but all over Europe, the UK’s standard suppliers are struggling to meet demand.

Ofgem revealed in 2021 that “there have been periodic issues with Norwegian and Russian pipelines, which has reduced gas imports from these major suppliers.”

Considering that Norway supplied 55% of the UK’s imported natural gas in 2020, this was a big blow.

Other countries that we buy gas from, like the Netherlands, are similarly dealing with record-breaking wholesale gas prices that mean they’re in no position to export large volumes, to the UK or anywhere else.

What impacts will this have?

Energy bills will rocket up

Most homes are still facing unusually high energy bills. The July to September energy price cap is lower than the previous cap, but double what it was in 2020.

The government put a £400 support package in place for all households from October 2022 to March 2023, but that’s over now. From July to September 2023, the average household will pay £2,074 per year on energy.

This price level will directly affect the 22 million homes currently on the default dual-energy tariff – which equates to 79% of all UK households.

And as an increasing number of smaller companies fold under the pressure, it makes it more and more likely that we’ll see less competitive pricing in the future.

The price of electricity is sky-high

We already know that the cost of gas is soaring, but so is the cost of electricity. At its worst point, the wholesale price of electricity has rose by 346% over 12 months.

This was largely because of the gas price spike, according to Ofgem, and the near-identical charts for gas and electricity prices displayed this fact.

And though the price of wholesale electricity has fallen along with its gas counterpart, it’s still unusually high.

The UK uses gas-powered plants to generate 35.7% of its electricity, according to government data.

A lack of gas means a lack of electricity, which means higher prices for both.

Energy suppliers are closing down

Dozens of energy companies have gone bust since the crisis started.

When 2021 began, there were 70 suppliers in the UK. Since then, dozens have folded.

And it’s not just small firms. Bulb, the UK’s sixth-largest energy supplier, went into ‘special administration’ until the government sold it to Octopus.

Public trust in energy companies is also very low, with 48% of Brits saying they don’t trust them, according to our 2023 National Home Energy Survey.

This is likely because energy companies like Centrica – which owns British Gas – have published record profits during this period.

Other industries have been affected

Industry body UK Steel has reported that production is being suspended during certain times of day at sites all over the country, because of the cost of gas.

Director general Gareth Stace said: “These extortionate prices are forcing some UK steelmakers to suspend their operations during periods when the cost of energy is quoted in the thousands per megawatt hour; last year, prices were roughly £50 per megawatt hour.”

Countless small businesses have announced they will have to close because of their soaring energy bills, and more will inevitably follow.

Every company that uses heat and electricity to power its offices has seen their costs rocket up – and those prices will stay high for a while.